Table of Contents

Find Out How Federal Withholding Tables 2021 Different From The Earlier Years. Besides, Further Information About The 2021 Federal Withholding Methods And Some Faqs Are Also Prepared.

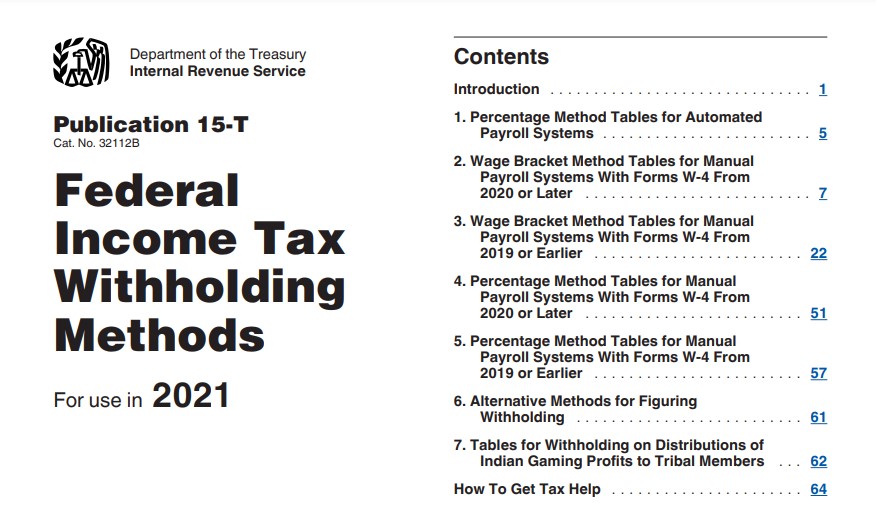

The IRS has just recently issued the newly publicized Federal Income Tax Withholding Methods for use in 2021. This publication, called Publication 15-T, is used to announce the difference in tax rate and to provide employers the methods to determine how much wage they should withhold from the employees. To show how much they should withhold from the employees, the IRS has also prepared the Federal Withholding Tables 2021 in that document.

This publication can be difficult to understand. But still, it is a great way to know about how the tax is counted according to the latest method.

What are Federal Income Tax Withholding Tables?

These are the set of tables that will help employers to find out the amount of withheld tax that should be taken from the employees’ wages. These tables can be found in the newest publication 15-T. In order to figure out how much tax should be withheld from the employees’ wages, the tables can be used after the employers compile and use the data found from the W-4 form, the employees’ filing statuses, as well as the tax frequency.

Where Can I Find Federal Income Tax Withholding Tables?

The methods to count the tax withholding, as well as the federal income tax withholding tables, can be found in the recent IRS-published publication 15-T. In this document, you will be able to find out the data required to count the employers must withhold from their employees’ wages. Mentioned in the document are two methods to determine the tax: percentage techniques and wage bracket.

How Does the Federal Income Tax Work?

Federal income tax is defined as the tax that is withheld from income – regardless of what type of income is. This type of income’ will include wage, salary, bonuses, tips and incentives, gambling money, and even unemployment benefit.

In the United States, the taxation system uses a progressive scale. To be explained simply: the more you earn, the more you pay the tax. In 2021, seven percentage categories are still applied as the tax rates, starting from 10%, 12%, 22%, 24%, 32%, 35%, to the biggest one, 37%.

Taxable Income for Federal Withholding Tables 2020 vs. 2021

To determine the withheld tax from each employee and proceed to use the federal withholding tables 2021, the taxable income should be counted beforehand. That is where those seven percentage categorizations are used. There has been a slight change of taxable income figures in 2021 if compared to the figures written in 2020. The tables below mentioned the taxable income rating for 2020 and 2021.

Taxable Income Table

-

Taxable Income Table of 2020

| Tax Rate | Taxable Income | |||

| Single | Married Filing Jointly | Married Filing Separately | Head of Household | |

| 10% | < $9,875 | < $19,750 | < $9,875 | < $14,100 |

| 12% | $9,876 – $40,125 | $19,751 – $80,250 | $9,876 – $40,125 | $14,101 – $53,700 |

| 22% | $40,126 – $85,525 | $80,251 – $171,050 | $40,126 – $85,525 | $53,701 – $85,500 |

| 24% | $85,526 – $163,300 | $171,051 -$326,600 | $85,526 – $163,300 | $85,501 – $163,300 |

| 32% | $163,301 – $207,350 | $326,601 – $414,700 | $163,301 – $207,350 | $163,301 – $207,350 |

| 35% | $207,351 – $518,400 | $414,701 – $622,050 | $207,351 – $311,025 | $207,351 – $518,400 |

| 37% | > $518,400 | > $622,050 | > $311,025 | > $518,400 |

-

Taxable Income Table of 2021

| Tax Rate | Taxable Income | |||

| Single | Married Filing Jointly | Married Filing Separately | Head of Household | |

| 10% | < $9,950 | < $19,900 | < $9,950 | < $14,200 |

| 12% | $9,951 – $40,525 | $19,901 – $81,050 | $9,951 – $40,525 | $14,201 – $54,200 |

| 22% | $40,526 – $86,375 | $81,051 – $172,750 | $40,526 – $86,375 | $54,201 – $86,350 |

| 24% | $86,376 – $164,925 | $172,751 – $329,850 | $86,376 – $164,925 | $86,351 – $164,900 |

| 32% | $164,926 – $209,425 | $329,851 – $418,850 | $164,926 – $209,425 | $164,901 – $209,400 |

| 35% | $209,426 – $523,600 | $418,851 – $628,300 | $209,426 – $314,150 | $209,401 – $523,600 |

| 37% | > $523,600 | > $628,300 | > $314,150 | > $523,600 |

Standard Deduction Increase

Aside from taxable income adjustment in federal withholding tables 2021, the standard deduction rate is also slightly increased. The new rate of the standard deduction is as mentioned below:

| Standard Deduction | Taxable Income | |||

| Single | Married Filing Jointly | Married Filing Separately | Head of Household | |

| 2020 | $12,400 | $24,800 | $12,400 | $18,650 |

| 2021 | $12,550 | $25,100 | $12,550 | $18,800 |

Computational Bridge (Optional)

The computational bridge is an optional method you can use in order to convert the earlier version of the W-4 form to the newer version. This is carried out if they want to treat the earlier forms of W-4 as if the W-4 2020 or later version.

Federal Income Tax Withholding Method: Wage Bracket Technique

The federal withholding tables 2021 can be used after you follow the method to determine the federal tax withholding. One of them is the wage bracket technique. This technique is a 4-step method in order to find the final amount of tax withheld. If you use this method, you will be required to do:

- Get the amount of adjusted wage, the methods are written in Step 1 (a-h).

- Figure out the tentative withholding amount (Step 2a)

- Account for tax credits (Step 3a-3c)

- Lastly, figure out the final amount to withhold for a pay period (step 4a-4b)

The aforementioned technique is used if the employer uses form W-4 from 2020 and later. If the employer works with form W-4 from 2019 and earlier, the methods will be slightly different and shorter. The federal withholding tables 2021 will also be different. The difference lies in the dismissal of step 3a-3c, as well as some steps from step 1.

Keep in mind that the wage bracket technique will be applicable to count withheld tax if the annual wage is under $100,000. If the annual wage is more than the figure mentioned, then the Percentage method will suit better.

Federal Income Tax Withholding Method: Percentage Method

This method can be used if the employees’ wages exceed $100,000 per year. Unlike the wage bracket, this method is applicable for any amount of wages. To use this method, you still need to collect the W-4 form and filing statuses from each employee. Aside from that, you should know how frequently you pay the wage to your employees – let it be a daily, weekly, biweekly, semimonthly, or monthly wage.

Along with the tables presented in the publication 15-T, the step-by-step tax counting method is also available there for both types of W-4 forms: 2019 and earlier versions, as well as the 2020 and later versions.

While filling out the worksheet provided in the document, you will need to look for the data shown in federal withholding tables 2021. This worksheet used to count tax withholding with W-4 form dated 2019 and earlier will be different with the worksheet used for W-4 form in 2020 version and later despite the slight difference.

For the 2020-version of a W-4 form, you will be required to do these things:

- Set the adjusted wage amount by completing step 1a-1h.

- Figure out the tentative withholding amount that can be completed by doing step 2a-2f

- Account for tax credits (step 3a-3c), and

- Determine the total final amount for withholding (step 4a-4b).

As for the 2019-version or earlier version, the computation process is shorter and it does not include ‘Account for tax credits’ as made for 2020-version W-4 form users.

Federal Tax Withholding Table 2021 (Publication 15-T 2021) Download & Printable

Loading...

Loading...

Frequently Asked Questions (FAQ) & Answers

What Is Federal Withholding?

A federal withholding is the amount of withheld tax by the federal government, counted according to the employees’ taxable income.

How Do You Figure Federal Withholding?

To find out the federal withholding figure, an employee ought to complete a W-4 form. Combined with the paycheck information, as the employer, you will be able to figure out their federal tax withholding accurately.

What Is The Federal Income Tax Rate For 2021?

The tax rate for 2021 is still similar to the previous year’s tax rate, starting from 10% and going progressively up to 37%. However, it’s the bracket you are included in which is slightly altered in 2021. The federal withholding tables 2021 issued by IRS provides this information.

Did Withholding Tables Change In 2021?

Yes, it did. It is the range of taxable income which has a small difference in number with the earlier table’s version.

How Much Do You Have To Earn Before Federal Tax Is Withheld?

There is a certain threshold for each kind of person. Let’s say, the threshold limit for a single adult under-65 is $12,000. If the person earns no more than that, then there are no taxes due. This will be slightly different with a single adult over-65, which has a threshold limit of $13,600 gross income annually.

How Do I Calculate Federal Withholding?

To count accurately, count on an IRS-released online calculator named Tax Withholding Estimator. In addition, using the worksheets provided in Publication 15-T can help you somehow.

Knowing how the federal withholding tables 2021 works is a great step in understanding how much withholding should be prepared per year. Moreover, its importance should be in one’s priority to know so that counting the tax itself can be carried out more accurately. The IRS has prepared an online Tax Withholding Estimator that you can use to figure out the tax approximate amount according to the most recent provision.