Table of Contents

Federal Withholding Tables 2021 – The IRS just lately released the newly promoted Federal Income Tax Withholding Methods use within 2021. This publication, known as Publication 15-T, is utilized to declare the difference in tax rate and to supply employers the methods to determine how much wage they ought to withhold from the staff. To show just how much they need to withhold from the employees, the IRS also has prepared the 2021 Federal Income Tax Table Chart in that file.

This publication could be difficult to comprehend. But still, it is a great way to know about how the tax is counted according to the latest method.

Exactly What Are Federal Income Tax Withholding Tables?

2021 Federal Income Tax Table Chart, These are the set of tables that can help employers to discover the total amount of withheld tax that should be extracted from the employees’ wages. These tables may be found in the latest publication 15-T. In order to work out how much tax ought to be withheld from your employees’ wages, the tables can be utilized after the employers put together and use the info identified from the W-4 form, the employees’ submitting statuses, as well as the tax consistency.

How Does the Federal Income Tax Work?

2021 Federal Income Tax Table Chart is described as the tax which is withheld from income– irrespective of what type of income is. This type of income’ will include wage, income, tips, bonuses and incentives , betting cash, and even joblessness reward.

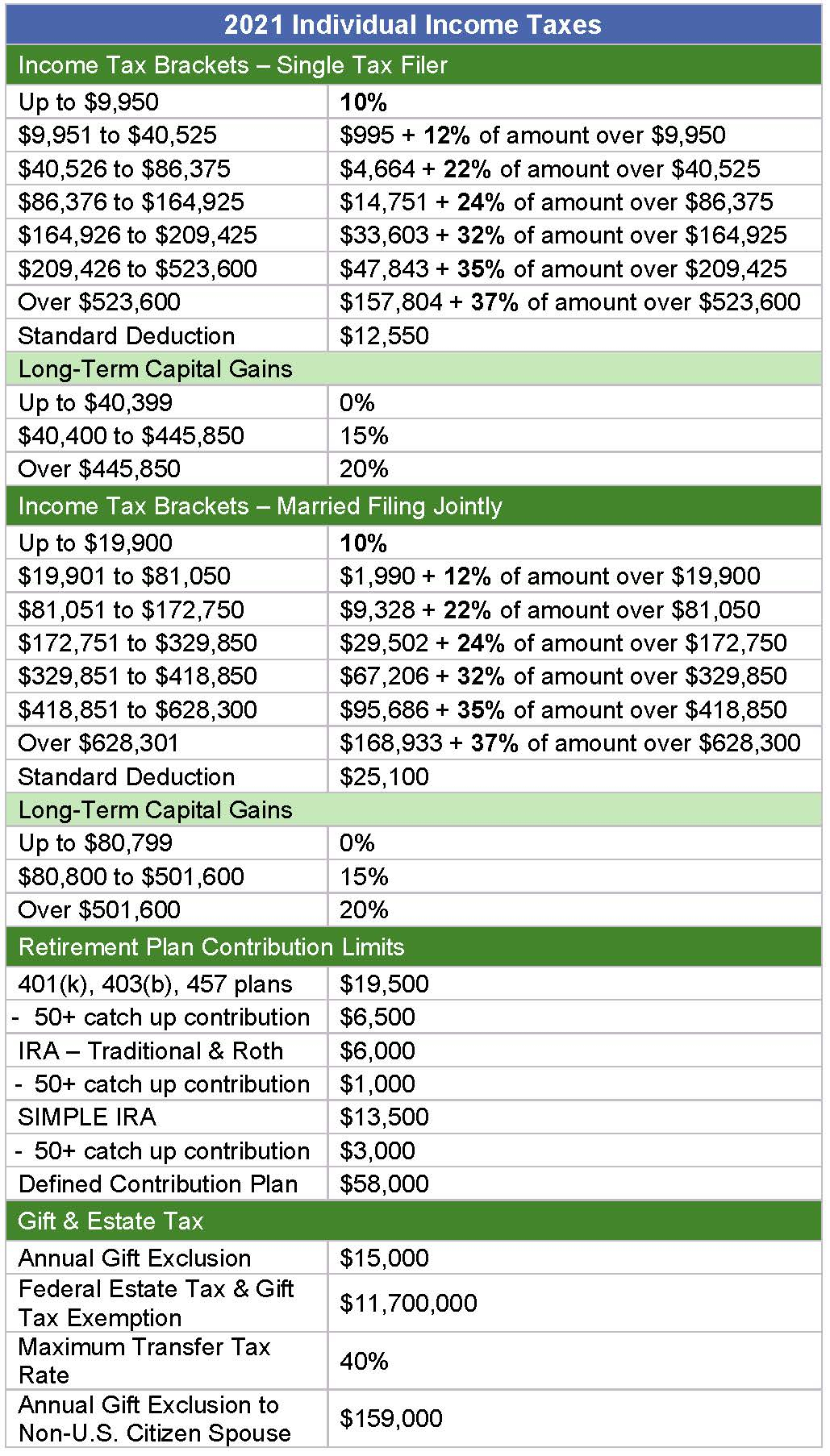

Within the United States, the taxation system utilizes a progressive range. To become described simply: the more you get, the better you spend the tax. In 2021, seven percentage categories continue to be utilized since the tax charges, beginning with 10%, 12%, 22%, 24%, 32%, 35%, to the greatest one, 37%.

Federal Income Tax Withholding Method: Wage Bracket Technique

The 2021 Federal Income Tax Table Chart can be used after you follow the method to determine the federal tax withholding. One of them is the wage bracket technique. This technique is a 4-step method in order to find the final amount of tax withheld. If you use this method, you will be required to do:

- Obtain the sum of altered wage, the ways are developed in Step 1 (a-h).

- Determine the tentative withholding sum (Step 2a).

- Account for tax credits (Step 3a-3c).

- Figure out the final amount to withhold for a pay period (step 4a-4b).

Federal Income Tax Withholding Method: Percentage Method

This method can be used if the employees’ wages exceed $100,000 per year. Unlike the wage bracket, this method is applicable for any amount of wages. To use this method, you still need to collect the W-4 form and filing statuses from each employee. Aside from that, you should know how frequently you pay the wage to your employees– let it be a daily, weekly, biweekly, semimonthly, or monthly wage.

Combined with the tables provided in the publication 15-T, the step-by-step tax keeping track of method is additionally accessible there for both varieties of W-4 forms: 2019 and before variations, along with the 2020 and afterwards variations.

Whilst submitting the worksheet supplied in the document, you need to look for the info shown in 2021 Federal Income Tax Table Chart. This worksheet used to count tax withholding with W-4 form outdated 2019 and before will be different using the worksheet employed for W-4 form in 2020 edition and afterwards despite the small variation.

Federal Tax Withholding Table 2021 (Publication 15-T 2021) Printable

Loading...

Loading...

Circular E 2021 (Publication 15 2021) Printable

Loading...

Loading...